With the advancement of technology and the rapid progress of the digital era, robotic automation is becoming an integral part of various industries, including finance. Of course, the insurance domain is no exception and benefits enormously from implementing such technologies.

In this article, we will delve deeper into how exactly robotic automation in the insurance industry began and how it is currently boosting insurance businesses. Moreover, we’ll discover examples of how robotics automation can be profitably implemented into insurance processes within different industries, from FinTech to Healthcare.

Introduction: What Is RPA in Insurance

As soon as a new undertaking or service enters the market, one of the management’s first questions is how to ensure its security and stability. The insurance industry protects against unexpected financial risk, making it one of the most important mediators in today’s world. However, the traditional system for processing insurance claims and claims could be slow and error-prone. With the increasing number of bankruptcy cases, lawsuits, crises, and other uncertainties worldwide, insurance services vendors have started to search for new solutions and technological developments in the industry.

The first steps in robotic automation of the insurance industry can be traced back to the end of the 20th century when the first assistant robots appeared on the scene in the form of automated systems capable of performing some tasks quickly and without errors. Even though we can say it was just basic computing, such automatic manipulations significantly saved time and helped workers do their jobs. They have been used to improve policy underwriting processes and reduce loss assessment and investigation time.

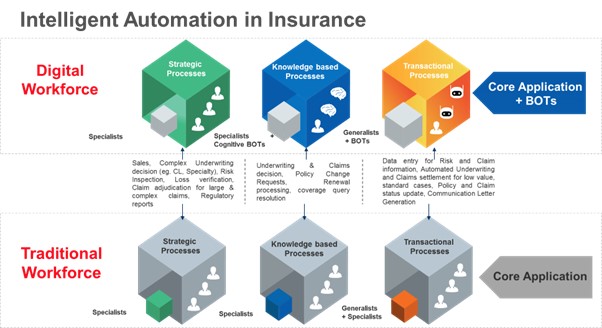

One of the key industries where robotic automation initially took off was data science. An important element in the insurance industry is assessing the likelihood of an insured event and determining the insurance cost for clients. Automated systems, powered by rich data and machine learning algorithms, could quickly analyze information based on various factors. Then, RPA in insurance allowed companies to offer more accurate and personalized offers.

Benefits of Implementing RPA in The Insurance Industry

Increased Efficiency

As pre-programmed machines, robots can work without brakes or stops, while a human is just a human. Predefined algorithms help robots that work for the insurance industry maintain significantly higher amounts of tasks than regular workers. We can’t say that, in this case, robots are way more reliable than humans; however, what we can admit a hundred percent is the fact that with RPA, the efficiency of the insurance processes is boosted.

Reduced Risks

Did you know that among all the errors occurring in the insurance processes, around 80% are human errors? Unfortunately, no one is safe from simple inattentiveness, laziness, irresponsibility, impatience, and other factors contributing to human errors among human personnel. Robots can’t get tired and suddenly start doing unprogrammed, weird manipulations, which a living person can do.

Optimization of Processes

Once they have invested in robotic automation, insurance business owners would do their companies a huge favor. After automating many routine tasks, it is clear that a one-time investment was worth all the saved costs. A robot won’t take vacations, maternity leave, sick leave, or additional time to rest and regain the energy spent on these repetitive tasks. One robot can do many people’s jobs without the risk of errors. Not spending additional costs on personnel training and education within their qualifications but simply programming the robot to do the needed algorithms is a huge optimization process.

Enhanced Customer Experience

Nowadays, the robotic technologies in the insurance industry have leveled up and provided many more unique features to enhance customer experience. As we all know, personalization is key to the client. Modern insurance companies have learned to optimize their Interaction with clients with robotics. Robots can offer new services, collect feedback, manage some individual premium features, do independent calculations for clients, maintain the whole conversation, etc. Unfortunately, robots will not give a “completely human interaction” feeling; however, RPA technologies upgrade yearly.

Faster Claims Processing

In the past, processing insurance claims was a tedious and time-consuming task. However, the time spent in settlement of claims can be substantially reduced by RPA. RPA brings efficiency to the whole claims process through the automation of data entry, document verification, and assessment. This results in faster claims settlement, meaning that policyholders are paid more quickly.

Data Management and Analysis

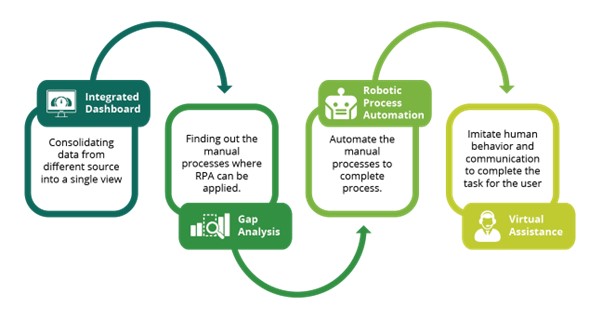

Given the shift towards a data-driven world, effective data management and analysis play an important role in the insurance sector today. RPA enables insurance companies to process and analyze huge volumes of data on time and accurately. Automated data collection from different sources is a way to ensure consistency and improve the quality of the decisions made by RPA. In addition, machine learning algorithms may offer valuable insights and predictive models that can facilitate risk assessment.

Improved Compliance and Regulatory Adherence

For insurance companies to maintain confidence and credibility in the industry, they must comply with and abide by regulations. By streamlining the monitoring and reporting of regulatory requirements, RPA provides a means to guarantee compliance. This automation minimizes the risk of failure to comply by minimizing errors made by humans due to obligations-related tasks. In addition, the RPA also makes it simpler to verify during regulated audits by providing transparency in the audit trail.

Challenges and Considerations in Implementing RPA in the Insurance Sector

Challenges

Process Standardization

Insurance processes often involve a range of variations due to specific customer needs, policy types, and regulatory requirements. Achieving process standardization across these variations is crucial for effective RPA implementation. Insurance companies must invest time and effort in mapping and standardizing processes before automating them with RPA. Failure to do so can lead to inconsistent results and decreased efficiency.

Data Security and Compliance

The insurance sector deals with sensitive information relating to customers, making data security and compliance a priority. Implementing the RPA calls for strong security measures to ensure that confidential data are protected. Providing appropriate controls on access, encryption, and compliance with data protection laws such as the General Data Protection Regulation shall be part of this. Insurance companies should thoroughly assess the safety features of RPA suppliers to ensure they follow industry best practices.

Change Management and Workforce Reskilling

RPA implementation can create significant changes in employees’ roles and responsibilities. Some tasks previously performed manually may become automated, which can lead to concerns about job security. Proper change management strategies, including clear communication and employee reskilling programs, are crucial to address these concerns effectively. Insurance companies should invest in workforce transformation programs to ensure employees embrace RPA as an enabler rather than a threat.

Considerations

Process Automation Suitability

Not many processes can be automated through RPA in the insurance sector. In light of their complexity, frequency, volume, and possible benefits, insurance companies should proceed with care in prioritizing these processes. Insurance companies can efficiently benefit from RPA to its fullest potential by focusing on processes that give them fast wins and high returns on investment.

Scalability

There is a high volume of data to deal with, which often causes fluctuations in workload for insurance companies. RPA solutions should be scalable and more efficient in handling the increasing volumes to meet these changes. Insurers should ensure that, in terms of volume and complexity, an RPA solution selected will be able to cope with growth over the next few years without affecting performance.

Continuous Improvement and Optimization

Successful RPA implementation is not a one-time process. Insurance companies should continuously monitor, measure, and optimize automated processes to deliver the desired outcomes. This requires dedicated resources for analyzing process performance, identifying bottlenecks, and making necessary adjustments to maximize the effectiveness of RPA.

Examples of RPA Use Implementations in Insurance

Case Study 1: Insurance Company

Imagine that an insurance company, a major player in the insurance industry, is implementing RPA to improve its policy administration processes. The company has successfully implemented automation of manual processes, e.g., generation of reports and policy renewal through the use of RPA. This has led to a substantial reduction in time and error and improved operational efficiency. The company’s staff could focus on more complicated and customer-centered tasks, resulting in increased revenues.

Case Study 2: Health Insurance

Suppose a well-known health insurance service provider implemented RPA to optimize its claims processing operations. Previously, claims processing was a manual process for entering data, verifying them, and adjudicating disputes, which led to delays and sometimes errors. The company has been using RPA to improve these processes and shorten the processing time of claims, thereby reducing error rates. Furthermore, RPA integration with Artificial Intelligence enabled the detection of potentially fraudulent claims and enhanced its capacity for detecting fraud. As a result, the costs to process claims were substantially reduced by the company.

Case Study 3: Life Insurance

RPA has been used by an insurance company, one of the world’s largest life insurers, to modernize its customer onboarding and policy issuance processes. These procedures have been subject to a range of manual steps, such as entering information, verifying documents, and issuing policies. The company has experienced significant cost savings, improved customer satisfaction, and increased revenues by recruiting new customers through fast and efficient services thanks to the RPA integration.

How Software Development Companies Can Facilitate RPA Implementation in Insurance Businesses

Understanding the Insurance Domain

Software development companies can play a vital role in enabling successful RPA implementation in insurance companies by possessing a solid understanding of the insurance domain. In-depth knowledge of insurance processes and practices allows software developers to identify areas where RPA can be most effectively applied.

Identifying and Prioritizing Processes for Automation

Software development companies with RPA expertise may conduct a process assessment in an insurance organization to determine and prioritize the processes that can benefit from automation. These companies can highlight the most significant benefits of automation regarding return on investment and operational efficiency by analyzing time-consuming and repetitive tasks as part of claims processing, insurance underwriting, or compliance obligations.

Customized Robotics Solutions

Collaborating with insurance companies, software development firms can create tailored robotics solutions to fit the business’s needs. By leveraging their technological know-how, they can customize RPA systems that seamlessly integrate with existing legacy systems, databases, and third-party applications.

Robust Support and Maintenance

Software development companies are a valuable resource for insurance businesses, providing ongoing support and maintenance services for RPA implementations. These firms can monitor and troubleshoot robotics solutions, ensuring continuous operation and swiftly addressing potential issues. With their specialized knowledge, they can also propose and implement enhancements to optimize the performance of the RPA system over time.

Conclusion

Software developers can be excellent partners for insurance companies that seek to exploit RPA’s potential as part of a constantly evolving landscape of the insurance sector. These companies can ensure successful RPA implementation that brings efficiency to operations, improves customer experiences, reduces errors, and enhances compliance by combining their experience in insurance software development. Several benefits result from RPA uptake, including improved customer experience, quicker claims processing, shorter turnaround time, data management and analysis, and better adherence to regulatory requirements.

![How to stop unwanted robocalls and text messages [Updated]](https://roboticsbiz.com/wp-content/uploads/2019/11/robocall-218x150.jpg)

![20 use cases of Robotic Process Automation (RPA) in banking [Updated]](https://roboticsbiz.com/wp-content/uploads/2019/10/automation4-218x150.jpg)